We deliver hands-on credit risk consulting, underwriting support, and regulatory readiness services to banks, financial institutions, and businesses nationwide.

.

Helping Banks and Businesses Navigate Credit Risk with Confidence

Independent Credit Advisory for a Changing Lending Environment

Trusted judgment. Practical solutions.

Our Expertise — Tailored Credit Risk Support Across the Lending Lifecycle

Credit Risk & Portfolio Management

-

Credit portfolio diagnostics & concentration analysis

-

Exception-based monitoring frameworks

-

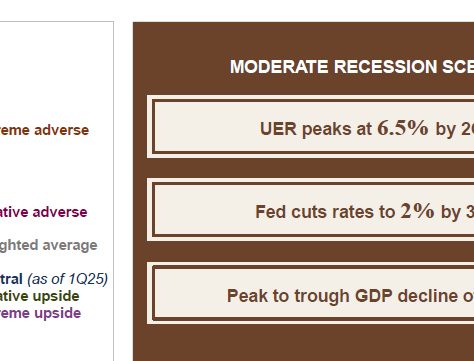

Stress testing & loss forecasting

-

Consumer and CRE portfolio review

-

Credit rating model development and validation

Support for institutions navigating complex portfolios and shifting credit landscapes

Underwriting & Risk Assessment

-

Independent credit reviews and underwriting support

-

Financial spreading and borrower assessment

-

Enterprise valuation frameworks for leveraged loans

-

Early warning systems and risk triggers

-

Credit training and staff upskilling programs

From spread to memo to risk rating, we bring structure and second-level thinking

Mergers & Acquisitions (M&A) Due Diligence

-

Pre- and post-deal credit risk reviews

-

Reverse due diligence (for sellers)

-

Risk-focused merger integration planning

-

Target portfolio risk assessment and loan review

-

Expertise in mergers of equals and complex community bank integrations

Trusted by PE sponsors and strategic acquirers alike

Strategic Advisory & Specialized Consulting

-

CECL methodology development and validation

-

Climate risk consulting and regulatory integration

-

Capital planning & risk-based capital frameworks

-

Fractional Chief Credit Officer support

-

Competitive benchmarking and peer insights

When market forces shift, we help clients adapt with foresight and flexibility.

Decades of Credit Judgment. Delivered with Boutique Precision

-

Led by former senior risk executives from Capital One and SRA Consulting

-

Over 25 years of experience across credit underwriting, portfolio risk, and M&A due diligence

-

Deep regulatory insight with credentials including CFA, FRM, and CRC

-

Trusted advisors to banks, credit unions, fintechs, and private businesses

We don’t just advise — we help you act with confidence in uncertain credit environments.